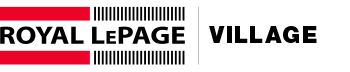

14% of GMA investors own three or more income properties, nearly double the national average of 8%

The rising cost of living and increased lending rates have recently put additional pressure on Canadians’ ability to save for the future. Looking ahead, many are choosing real estate investing as a means to build wealth, trying to take advantage of the market downturn of the past year. The Greater Montreal Area real estate market, with its greater affordability, offers more opportunities to acquire residential properties for investment purposes compared to the other two major Canadian urban centres.

A recent Royal LePage survey of residential investors conducted by Leger1 reveals that 14% of Greater Montreal Area investors own three or more income properties (nearly double the national average of 8%) and significantly more than investors in the Greater Toronto Area (6%) and Greater Vancouver (7%). Of the Montreal investors surveyed, 52% say they are likely to buy another investment property within the next five years.

The attractiveness of investing in real estate in Montreal is not unrelated to the fact that property prices are much more affordable here than in Canada’s other two largest cities. Real estate is a powerful investment vehicle because of the leverage offered by the mortgage, as you can own 100% of the asset with as little as 20% down on an income property. What’s more, the amount of money required to put a down payment on a building in Montreal is far less compared to a similar property in Toronto, where the market value is almost double. This partly explains why investors in Montreal own more investment properties than elsewhere in the country.

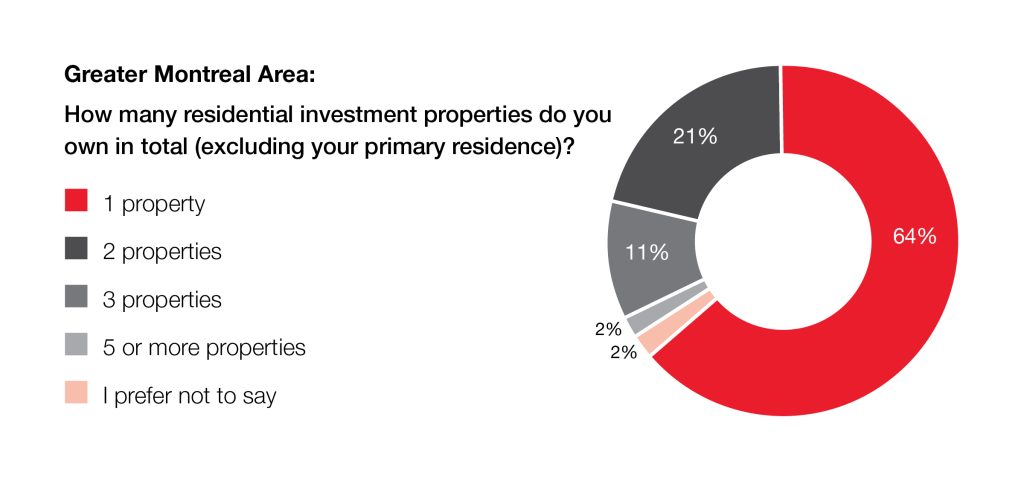

According to the survey, the most popular type of investment property for Greater Montreal Area investors is a condominium, at 33%. Among the three greater regions, Montreal investors are more likely to own an entire duplex (18%) or triplex (17%), while these property types are far less common in the Greater Toronto Area and in Greater Vancouver.

Montreal’s housing stock is unique because it is older, which gives it a very different architectural and urban planning design, which explains the strong presence of plexes. Unlike investors in Toronto and Vancouver, who are faced with higher purchase prices, Montreal real estate investors can benefit from potentially higher profitability ratios, with lower monthly carrying costs. In addition, Montreal’s rental housing stock allows a duplex or triplex owner to live in their unit at a lower cost since it is partially financed by the other tenants, which is less common elsewhere in the country.

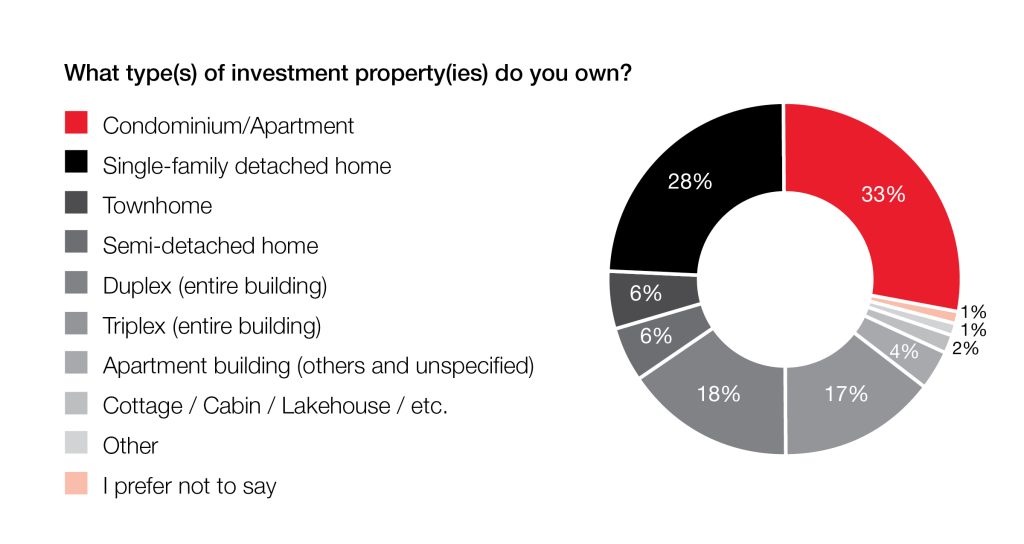

26% of investors in the GMA say that increased lending rates have caused them to consider selling one or more of their investment properties, a rate that is lower than the Greater Toronto (36%) and Greater Vancouver (28%) regions.

In addition, 20% of investors in the Greater Montreal Area say they are likely to sell one or more of their investment properties within the next two years. That figure rises to 24% and 28% respectively, in the greater regions of Toronto and Vancouver.

The rise in interest rates in 2022 was significant and rapid, so some investors were not able to absorb these costs quickly enough. Since the financial risk of real estate investment is lower in Montreal due to lower property prices, investors’ capacity to hold onto these real estate assets may be less threatened when interest rates rise. For the next few years, we would anticipate that inflation levels and interest rates will return to lower levels, which could stimulate the appetite for real estate investment. At the same time, the pace of housing starts is not keeping up with existing and future demand, which should continue to drive up property values.

Contributor:

Source: Royal LePage Canada May 2023